Lithium-ion batteries are the backbone of the electrified world. They power smartphones, laptops, electric vehicles, and grid-scale storage systems — connecting mining, chemistry, and high-precision manufacturing into one global network.

How They Work

A lithium-ion cell stores and releases energy by moving lithium ions between two internal layers:

- the cathode, made from lithium combined with metals such as nickel, manganese, or cobalt, and

- the anode, typically made from graphite.

When charging, ions move into the anode; when discharging, they return to the cathode — generating electric current.

Behind this elegant mechanism lies one of the most complex and strategic industrial chains of the 21st century.

Materials and Origins

Every lithium-ion battery depends on five essential raw materials — lithium, nickel, cobalt, manganese, and graphite — each contributing to the balance between energy density, stability, and cost.

| Material | Function | Main Producing Countries (2024) | Source |

|---|---|---|---|

| Lithium | Carries charge between electrodes | Australia, Chile, China, Argentina | USGS 2024 |

| Nickel | Increases energy capacity | Indonesia, Philippines, Russia, Australia, Canada | USGS 2024 |

| Cobalt | Stabilizes the cathode | D.R. Congo, Indonesia, Russia, Australia | USGS 2024 |

| Manganese | Improves structural stability | South Africa, Gabon, Australia | USGS 2024 |

| Graphite | Stores lithium ions in the anode | China, Mozambique, Madagascar, Brazil | USGS 2024 |

Australia remains the largest lithium producer, followed by Chile and China.

The Democratic Republic of Congo dominates mined cobalt supply — much of it extracted through artisanal operations monitored under OECD Due Diligence Guidance (2024) for labor and transparency standards.

Nickel production continues to rise sharply in Indonesia, which has become a central pillar of the global EV supply chain.

From Ore to Chemical Input

Mining provides ores and brines containing only trace amounts of usable metals. Refining transforms these raw materials into high-purity compounds that feed directly into battery material production:

- Lithium → lithium hydroxide or lithium carbonate

- Nickel / Cobalt → nickel sulfate and cobalt sulfate

- Manganese → manganese sulfate

- Graphite → purified or synthetic powder

These refined materials, known as precursors, are the foundation for the cathode and anode layers that store and release energy.

According to the IEA Critical Minerals Outlook 2024, China controls about two-thirds of global lithium-refining capacity and over 85 % of cathode and anode material production.

Between 2020 and 2023, midstream capacity expanded at roughly twice the rate of the late 2010s, marking the fastest growth period in the sector’s history.

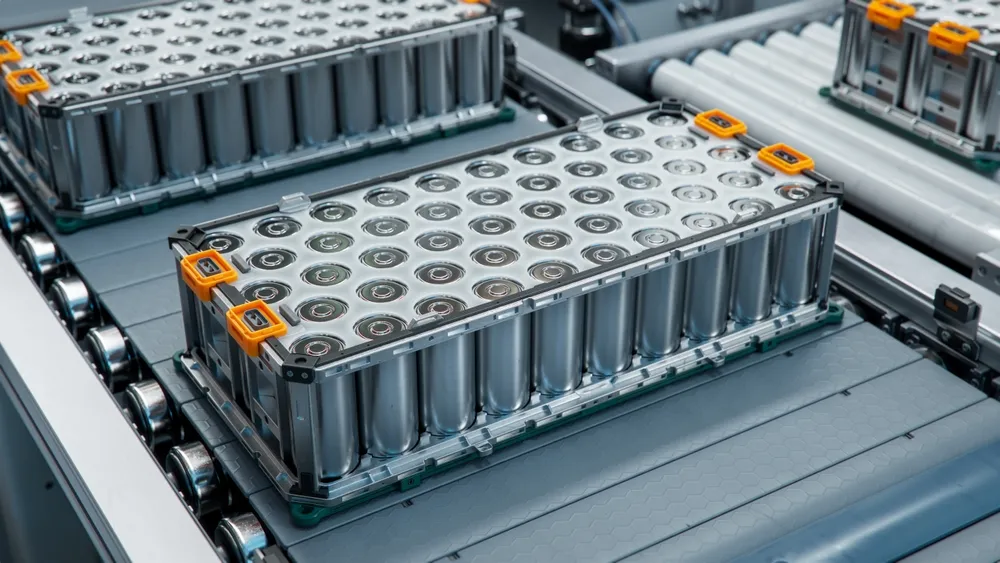

Active Materials and Cell Assembly

Once refined, materials are converted into active components — the powders and films that form the core of a battery.

Cathode and anode layers are coated onto foils, stacked or rolled with separators, and filled with electrolyte solution to form a cell.

Cells are grouped into modules, and modules into battery packs, which power electric vehicles or grid systems.

A typical mid-size electric vehicle uses a battery pack storing around 60–100 kWh of energy, depending on range and configuration.

Based on data from BloombergNEF (2024) and automaker disclosures, 1 GWh of cell output can power roughly 10 000–15 000 vehicles — a widely accepted industry benchmark for scaling factory capacity.

Industry Structure — The Corporate Chain

Battery production forms a continuous chain of specialized industries — from resource extraction to vehicle integration:

| Stage | Leading Firms | Function |

|---|---|---|

| Mining | Albemarle, SQM, Pilbara Minerals, Glencore | Extraction of ores and brines |

| Refining | Ganfeng Lithium, Tianqi Lithium, Huayou Cobalt, Sumitomo Metal Mining | Conversion to battery-grade chemical compounds |

| Active Material Production | BASF, Umicore, BTR, LG Chem | Manufacturing of cathode and anode powders |

| Cell Manufacturing | CATL, BYD, LG Energy Solution, Panasonic, Samsung SDI, Tesla | Assembly of electrodes into cells and modules |

| Vehicle Integration | Tesla, BYD, Volkswagen, Hyundai | Installation into electric vehicles and energy systems |

This industrial ecosystem has become one of the most capital-intensive supply chains in the world — bridging mining, manufacturing, and energy policy.

Where Production Happens

Battery manufacturing remains concentrated in East Asia.

The IEA Global EV Outlook 2024 reports global cell-manufacturing capacity at around 3 TWh in 2024, up from less than 1 TWh in 2020.

Roughly 85 % of that capacity is located in China, followed by South Korea and Japan.

| Stage | Global Capacity (2024) | China’s Share | Main Competitors |

|---|---|---|---|

| Lithium refining | ≈ 1.0 Mt LCE capacity | ≈ 65 % | Chile, Australia |

| Nickel & Cobalt refining | — | ≈ 70 % | Indonesia, Japan |

| Cathode & Anode materials | — | ≈ 80–85 % | South Korea, Japan |

| Cell manufacturing | ≈ 3 TWh capacity | ≈ 85 % | South Korea, Japan, U.S., EU |

(Sources: IEA 2024; USGS 2024; Benchmark Minerals Intelligence 2024)

When combined, China, South Korea, and Japan account for around 75–80 % of global battery production capacity — a figure derived directly from IEA and Benchmark data.

This concentration reflects decades of industrial policy, supply-chain integration, and early investment in EV manufacturing.

Trade and Market Scale

The lithium-ion battery sector is now among the world’s fastest-growing manufacturing industries.

Global production and trade routes connect Asia’s refineries and gigafactories with North American and European automakers, anchored by ports such as Shanghai, Busan, Nagoya, Rotterdam, and Houston.

Battery components have become as strategically significant to trade policy as semiconductors or energy resources.

Environmental and Governance Challenges

Rapid expansion has magnified structural and sustainability challenges:

- Water use — Lithium extraction from brine consumes large volumes in arid regions like Chile’s Atacama Desert.

- Waste and emissions — Nickel refining and graphite purification generate tailings and toxic by-products.

- Labor practices — Artisanal cobalt mining in the DRC remains under OECD and NGO monitoring for human-rights risks.

- Supply concentration — Heavy reliance on one refining hub leaves Western supply chains exposed to disruption.

Outlook — Building Security and Scale

The IEA (2024) projects global battery demand to rise five- to seven-fold by 2035, driven by electric-vehicle adoption and grid-storage growth.

Emerging technologies such as solid-state and sodium-ion batteries may diversify chemistry, but the core inputs — lithium, nickel, and graphite — will remain critical through at least 2040 across all major energy-transition scenarios.

Western policy initiatives — including the U.S. Inflation Reduction Act, the EU Net-Zero Industry Act, and new Asian battery partnerships — aim to localize refining, expand recycling, and secure raw-material supply.

Control over battery chemistry is now a strategic question — as consequential as the energy it enables.

Sources

- U.S. Geological Survey (USGS) – Mineral Commodity Summaries 2024

- International Energy Agency (IEA) – Global EV Outlook 2024; Critical Minerals Outlook 2024

- OECD – Due Diligence Guidance for Responsible Mineral Supply Chains (2024)

- UNEP – Environmental Impacts of Battery Production (2024)

- Benchmark Minerals Intelligence (2024) – Battery Gigafactory Database

- BloombergNEF (2024) – Industry capacity and EV output metrics

- Reuters / Financial Times (2024) – Market data and corporate disclosures